Hiring the right nanny, personal assistant, or other domestic employee can be integral to your well-being, but it shouldn’t come at an undue cost. In order to accurately forecast the total cost of hiring household help, there are many employment requirements that you should contemplate before beginning the recruitment process. Some factors, like the employee’s work schedule and hourly wage, are obvious contributors to cost. However there are other factors (like overtime pay requirements, employment taxes, required insurance policies, and mandated benefits) that can quickly add up.

Creating an accurate budget at the outset will save time upfront and help avoid costly errors down the line. Follow these five tips to help you estimate the true cost of hiring household staff.

Three tips for estimating the cost of a household employee

1. Set a competitive (and compliant) pay rate

Setting a market-competitive wage for the position will dictate the quantity and quality of your applicant pool. Make sure to do your research to understand what the market rates are for the role you’re looking to fill. Benchmarking data is available through resources like the Bureau of Labor Statistics.

It’s also important to make sure you don’t run afoul of minimum wage requirements in your state and local jurisdiction. Many states have a separate minimum wage requirement higher than the federal rate, and 50+ additional cities and counties require an even higher minimum wage than their state’s requirement. These requirements can change at least twice a year, so it’s important to not only set the rate correctly at the outset, but also to ensure you’re keeping tabs on any changes over time.

2. Establish a schedule

Your specific needs will dictate the schedule for the household employee. However, there are a few additional factors to consider for budgeting purposes. The most important factor – and the one most employers inadvertently get wrong – is overtime. Hourly, non-exempt employees are required to be paid “time and a half” (1.5x their regular hourly rate) for ALL hours worked over 40 in a week per the Fair Labor Standards Act.

Additionally, if you reside in Alaska, California, Colorado, Illinois, or Nevada, there are separate (and more stringent) overtime requirements you will need to adhere to, including double time and daily overtime rates in California. The monetary impact of required overtime pay will depend not only on the total number of hours worked per week, but also on the number of hours worked per day, or the number of consecutive shifts worked.

It’s important to note that employees cannot waive their right to overtime pay or participate in arrangements where they work fewer hours the next day in exchange for unpaid overtime on other days. Regardless of willingness on either side to comply with overtime laws, they are a firm legal requirement for employers in the U.S. Non-compliance can result in financial penalties, and overtime-related lawsuits are some of the easiest, most employee-friendly cases to win.

Two additional scheduling considerations for budget purposes:

- Consider hiring multiple employees: If the role requires a more intensive schedule, consider hiring multiple employees. Not only will this limit the cost impact of overtime, it can help employees avoid burnout in labor-intensive roles such as caregiving, and also provides backup options if an employee is sick or can’t make a shift.

- Apply a sleep time deduction: For live-in caregivers or other employees who may be working a 24-hour shift, you can apply a sleep time deduction when the employee is able to get a minimum of 5 uninterrupted hours of sleep and is provided with adequate sleeping quarters separate from the person receiving care. This deduction is permissible in all states except California, and is only meant for overnight periods when the employee is not working.

3. Understand employer taxes and other mandated benefits

In addition to withholding taxes from the employee’s wages, all employers – even household employers – are also required to pay employer payroll taxes. FICA tax includes social security (typically around 6% of wages) and Medicare (typically around 1-2% of wages) paid by the employer. In addition, you will need to pay federal unemployment taxes (FUTA) as well as state unemployment taxes (SUTA).

Depending on where you live, you may also need to budget for mandated paid time off and other benefits dictated by state, county, and city laws. For example, in California employers are required to provide 24 hours of paid sick leave time per 12 month period for all full-time employees. The number of states, cities and counties requiring some kind of mandated paid benefit is growing rapidly. As of the writing of this article, nearly 20 states and Washington DC require paid sick leave – and that’s not counting additional benefits required by cities and counties. The number has been increasing rapidly over the past five years and even more quickly since the COVID-19 pandemic.

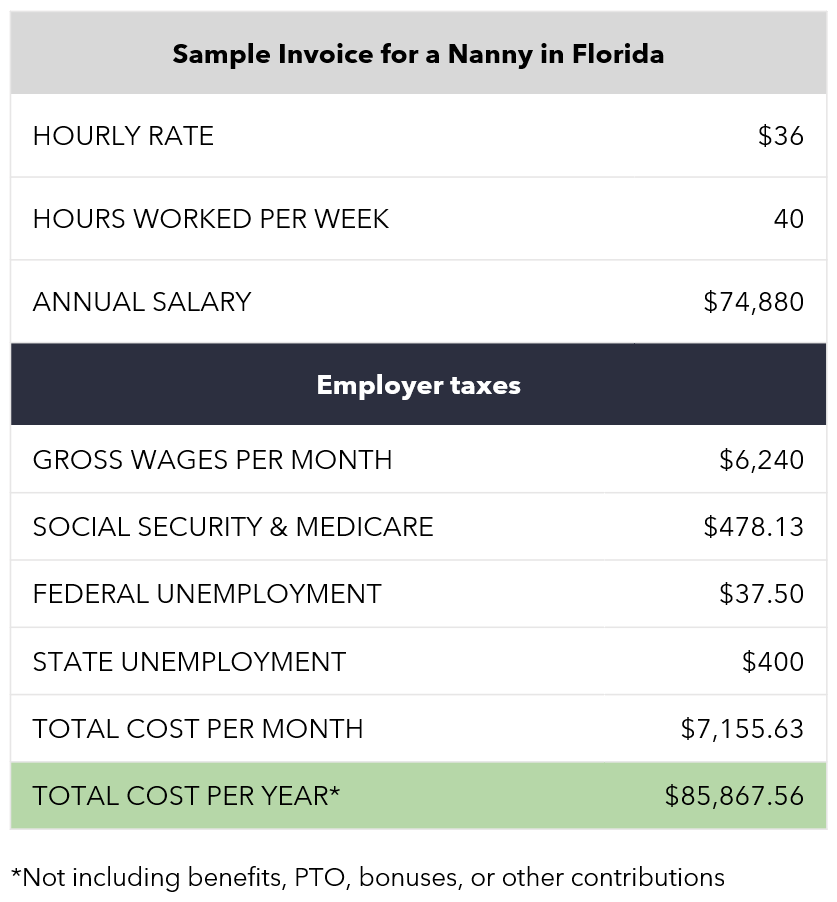

Let’s take a look at an example of how paying required employer taxes can affect your overall budget:

The annual cost for a nanny in Florida that works 40 hours a week and makes $36 per hour is roughly $75,000. With employer taxes included, the total cost comes to about $86,000. This $11,000 difference not only translates to doing the right thing by your workers, but it also protects you against potential lawsuits and penalties by paying taxes correctly and proactively.

While paying taxes may increase your upfront cost of hiring a household employee, it’s ultimately a well-worth investment to be covered, compliant, and keep yourself out of hot water.

4. Provide mandated insurance

Workers’ compensation insurance is required by 49 U.S. states and is the employer’s financial responsibility. It’s important to have the proper coverage if an employee is injured on the job, however, even if no injuries occur, failure to have the required coverage can result in significant fines (and is a criminal offense in some states).

Most homeowners’ insurance policies specifically exclude coverage for household employees. It’s important to read the policy (and exclusions) carefully before assuming employees are covered. If you are found to have an employee working for you without a workers’ compensation policy, you could be in hot water. In the best case, you’re facing a steep fine and a thorough investigation. In the worst case, you could be facing jail time.

5. Consider working with a household employment specialist

It’s easy to forget that you will need to purchase software to run payroll, provide W-2s, and file quarterly taxes, or pay a service to do so. Many household employers find that the headache of staying current with ever-changing tax, payroll, and employment laws is contrary to their mission of hiring household staff to reduce their stress and make their lives go more smoothly, so outsourcing these duties is common.

Whether you are working with a payroll service, an accountant, or a more comprehensive Employer of Record service like TEAM, you’ll need to pay for these services to ensure they’re done compliantly, so it’s important to include this cost in your budget as well.

Save time, money, and headache by accurately budgeting for household workers

Planning for the costs of employment beyond employee wages will help you build a more accurate budget – one that reflects the true cost of safe, compliant household employment. However, this is merely the cost of tax and employment law compliance: to attract and retain skilled workers in today’s competitive labor market, many employers are also offering perks that domestic workers haven’t always enjoyed. Bonuses, reimbursement for mileage, holiday pay, generous paid time off plans, paid leave, reimbursements for healthcare, and comprehensive medical insurance are a few benefits that can quickly affect your bottom line, and can typically only be offered once you know the true cost of compliant household employment.

If you’re looking for a service to provide an accurate budget and handle all aspects of payroll, taxes, insurance, and compliance, learn more about TEAM’s all-in-one payroll and HR administration service.