Are you looking to hire workers in your home, such as caregivers, nannies, or personal assistants? If so, you may be tempted to treat the situation like you would if you were paying someone to fix your roof or remodel your kitchen. On the surface, this seems like a straightforward connection to make – after all, they all share the common goal of providing services in your home. In reality, hiring household workers can open a can of worms with serious legal and financial consequences.

That’s because one of the most common (yet easily avoidable) mistakes people make when hiring domestic staff is misclassifying them as an independent contractor. It’s critical to know that neither you nor the worker themselves can make the determination about whether they are an employee or a contractor.

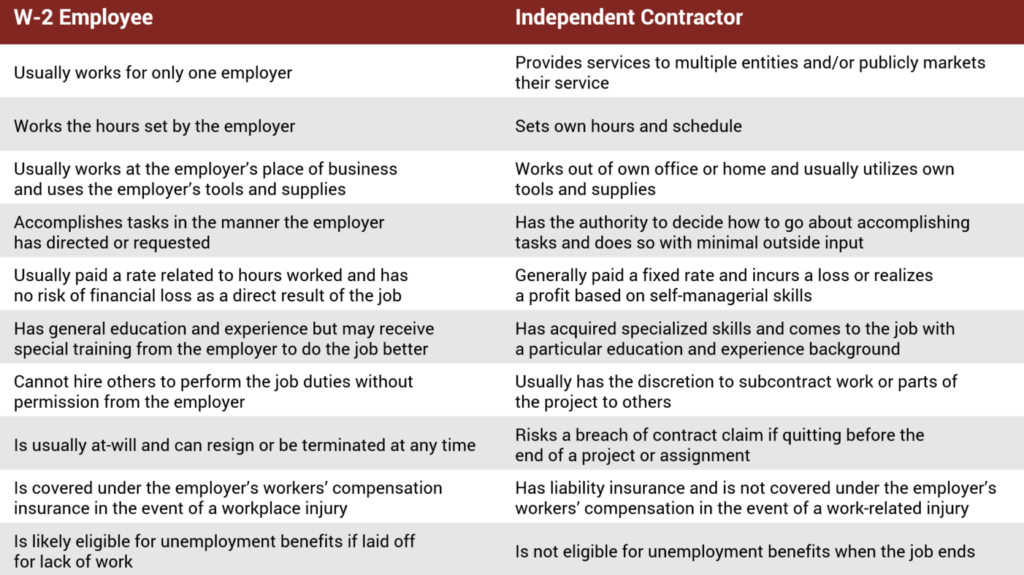

So how are you supposed to know the difference? Fortunately, the contractor vs. employee criteria are outlined by the various “tests” that are set by federal and state agencies such as the IRS, the Department of Labor, and your state or local labor commission.

The IRS’s rules are broadly considered the guiding light for determining worker classification, unless you employ workers in a state with stricter misclassification laws, such as California or New Jersey. The IRS provides three broad criteria to consider:

- Behavioral control

- Financial control

- Type of relationship

Depending on these criteria, a worker may be a true independent contractor and free agent, or a W-2 employee of the household. If the latter, this means that you become an employer – and in doing so, must comply with employment laws and regulations related to wage requirements, overtime policies, benefits, human resources issues, and so much more.

10 KEY DIFFERENCES BETWEEN AN EMPLOYEE AND AN INDEPENDENT CONTRACTOR:

Let’s take, for instance, a worker hired to paint a house or renovate a bathroom. The worker has likely signed a contract to complete a project for the household, but they likely have other clients and are not financially dependent on this single job. This type of contract worker will provide an estimated cost for the project, and use a 1099 federal income tax form to report earnings. On the other hand, let’s examine a long-term household worker like a nanny or caregiver. In most situations, these employees are told when to show up for work, they earn an hourly wage, and this job is their primary source of income. By law, these workers are employees of the household’s payroll, and must report earnings on a federal W-2 tax form.

Contrary to popular belief, you cannot classify a household employee as an independent contractor simply because they request it. Doing so can have unintended consequences down the road.

IGNORING EMPLOYMENT CLASSIFICATION LAWS CAN HAVE COSTLY CONSEQUENCES

Contracts between workers and employers that attempt to alter the nature of federal laws around misclassification can land both parties in hot water when it comes to employment compliance and tax liability. Only the nature of the working relationship between the hiring individual and the worker will determine the classification status.

The issue of proper classification has been magnified in the past few years, as even large corporations such as Uber, Amazon, and Grubhub have come under fire for misclassifying employees as independent contractors. The scrutiny that even large, multinational corporations are under when it comes to misclassification does not bode well for smaller businesses or domestic employers.

In 2019, a federal judge in Washington State ruled against Amazon in favor of the contract truck drivers who were looking to proceed with a class action lawsuit against Amazon. “Plaintiffs say that although they are contract truck drivers, they are required to undergo unpaid company training and are subject to company rules–like an employee. Amazon issues specific instructions on how and where to deliver packages, dictates the delivery order and specified routes. If drivers miss scheduled shifts or fail to follow company policy, plaintiffs say they are subject to termination.”

ACCURATE CLASSIFICATION CAN LEAD TO HAPPIER EMPLOYEES

It’s also important to note that employment status is becoming a major part of retention for workers – in fact, household workers increasingly want to be properly classified as W-2 employees for their own benefit. The labor market is changing rapidly, and it’s not uncommon for workers to make proper employment classification a requirement when beginning a new job. Increasing levels of knowledge and attention paid to these issues means that more workers will not stand for arrangements that may someday put their tax liability at risk, and states are taking workers’ sides more and more often.

Ultimately, the person who is hiring the worker has the burden of proving that the worker is not an employee. Many states are beginning to implement laws stating that all workers are employees unless explicitly proven otherwise, and that contractor status must be proven in writing.

WHEN IN DOUBT, SEEK GUIDANCE FROM AN EXPERT

The risk of noncompliance can be significant and expensive for both parties. When deciding on a worker’s classification, you should be 100% confident that your potential contractor does not, in fact, count as an employee. If you are still unsure of the correct classification, it’s always best to consult an employment attorney or other subject matter expert.

For more information about navigating household employment matters and understanding whether your household workers are employees or independent contractors, contact TEAM’s household employment experts.