Are you paying a caregiver from a trust, or other types of service providers such as companions or family members on payroll? If so, it’s your duty to manage this employment situation properly and abide by the applicable labor laws. These employment arrangements are often managed casually, especially when the employee performing the work is someone you know. However, employment laws still apply, and you can be found personally responsible for noncompliance.

To keep yourself out of hot water and minimize risk, there are a few key factors to keep in mind anytime there are ongoing disbursements from the trust to someone who is not the beneficiary.

4 Things to Consider When Paying a Caregiver from a Trust

1. Is the caregiver classified as an employee or independent contractor?

Is it easier to issue a caregiver a 1099 at the end of the year? Sure. Is that approach correct in the eyes of the IRS and Department of Labor? Probably not.

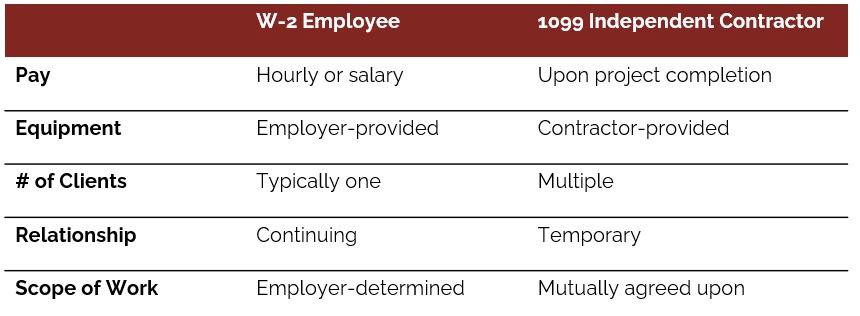

Caregivers’ job duties and employment structure almost always fall under that of a W-2 employee. Some factors include working for one employer, accomplishing tasks set by the employer, and having an ongoing working relationship. An independent contractor has their own business, works for several clients, sets their own schedule and pay rate, and procures their own insurance.

An employee can never waive their right to being an employee, as employers are required to follow the classifications made by the IRS. Failure to properly classify an W-2 employee can lead to hefty fines, audits, and a slew of back taxes. If you’re uncertain on how to classify a worker properly, the best practice is to seek legal advice from an employment expert or tax attorney.

2. Do you know how to handle the caregiver’s payroll?

A common compliance pitfall when paying caregivers from a trust is mishandling payroll. Since these relationships are often handled casually, the pay setup can follow suit – but although paying a caregiver under the table may seem to simplify the arrangement, noncompliance can be costly.

Another problem with paying a lump sum or classifying an employee as an independent contractor is that both the employee and employer are not paying into the required federal and state taxes. For example, when a beneficiary passes away and the caregiver is laid off, he or she may attempt to collect unemployment benefits. If unemployment taxes were not paid by the employer, the state and IRS may start an investigation that could lead to penalization of the trust and/or fiduciary.

3. Are you paying the caregiver for overtime?

As with other non-exempt employees, private caregivers are also entitled to receive overtime by the Fair Labor Standards Act (FLSA). On a federal level, all non-exempt employees that work 40 or more hours in a week must receive overtime pay. However, some states (such as Alaska, California, and Colorado), have daily overtime and double time laws for any hours worked beyond eight or 12 hours in a day.

A common example is when a handshake agreement is made to pay a caregiver a flat weekly amount so that their schedule remains flexible and they don’t have to track their hours. Both parties may find this amenable, as it’s predictable for your budget and the employee appreciates the lack of administrative burden.

However, nothing is stopping the employee from submitting detailed timesheets and opening up a wage claim with the state – even years later. They could easily argue they weren’t compensated for overtime since they were paid a flat rate. The employer will have no evidence to prove otherwise, so the court will typically err on the side of the employee, which can carry severe financial and legal consequences for the trust.

Employers who fail to pay overtime can face significant lawsuits and fines. Not only will they be required to back pay those hours along with an additional penalty, they could also be responsible for paying the employee’s legal fees if brought to court. To avoid an overtime violation altogether, be sure to have your employee record all hours worked, retain those timecards for three years (or as long as required by law), and refer to your state’s guidelines on overtime.

4. Do you have the required insurance for the caregiver?

In almost every state, workers’ compensation insurance is required for every employer – even households with just one worker. Workers’ compensation insurance is especially important for households with caregivers, as it is a profession that is more prone to injury due to the manual labor it requires. Injuries can happen from lifting a beneficiary out of bed or walking them down the stairs, especially in a private home that may not be OSHA-compliant for standard healthcare roles, let alone for home health. If a caregiver has to go to the hospital for a workplace injury, the hospital and the employee’s private insurer will look to you, as the employer, for coverage. If you are found without coverage, it can be considered a criminal offense.

It’s a common misconception to assume a homeowners’ insurance policy covers household employees. Unfortunately, those policies are usually meant for temporary contractors performing work on the home, and typically always have exclusions for ongoing employment. The employer and homeowner will likely still be held liable.

Being a household employer can be complex and tricky

When paying a caregiver from a trust, there are very specific guidelines you must follow to ensure the caregiver has a safe work environment. Not only does this protect the employee, it also helps safeguard the trust assets. The first steps to being compliant are accurately classifying the worker as a W-2 employee, properly handling payroll and overtime, and maintaining the legally required insurance policies.

If handling the complexities of payroll and human resources administration sounds complicated and time-consuming – all while staying abreast of changing employment laws and regulations – that’s because it is. The good news? TEAM has specialized in this for over 20 years. If you’re interested in saving time by outsourcing the administrative burden and offloading the risk to the trust and your organization when something inevitably goes awry, contact us to learn more about our all-in-one payroll and HR solution.

Notice: The information provided is for general informational purposes only and should not be construed as legal advice. No attorney-client relationship is formed by your use of this website. You should always seek the advice of a qualified attorney for your specific legal needs.